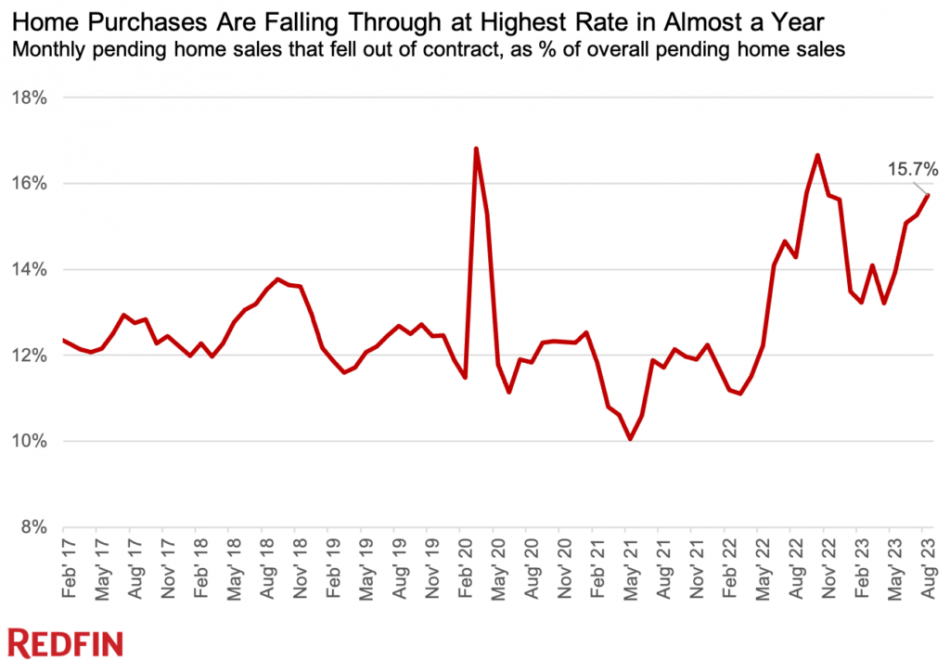

Whether it was cold feet or high rates, would-be buyers pulled out of sales at near-record rates last month. According to Redfin, nearly 60,000 home-purchase agreements were canceled in August nationwide, equal to 15.7 percent of homes that went under contract.

That’s up from 14.3 percent a year earlier and marks the highest percentage since October 2022, when mortgage rates surpassed 7 percent for the first time in two decades. At one point last month, the average rate hit 7.23 percent—the highest since 2001.

Locally, Riverside saw 21.1 percent of pending sales fall through in August. San Diego and Los Angeles each had a 16.3 percent cancel rate, while Anaheim had a 14.7 percent cancel rate.

Pending sales declined 0.6 percent from a month earlier in August on a seasonally-adjusted basis, and fell 18.1 percent year-over-year.

“Home prices will likely remain elevated for the foreseeable future,” said Redfin Economics Research Lead Chen Zhao. “The Federal Reserve still has more work to do in its battle against inflation, which means mortgage rates are unlikely to come down anytime soon. As long as rates remain high, homeowners will be reluctant to sell. And that lack of homes for sale will keep prices high because it means buyers are duking it out for a limited supply of houses.”

![[Valid RSS]](https://californialistings.com/wp-content/uploads/2021/03/valid-rss-rogers.png)