With a June 1 deadline looming amid fears the U.S. government could default on payouts, Zillow has released worst-case scenario projections for the national housing market.

If Congress and the White House are unable to reach an agreement to raise the debt ceiling, Zillow researchers say home sales volume would likely decline sharply, with projected deficits of up to 23 percent fewer sales than otherwise expected.

Home values could also be 5 percent lower than a no-default forecast by the end of 2024.

“Even though a short default would be enough to inflict a tremendous amount of economic damage, that’s no reason to count on it being a short one – the political gridlock that resulted in default, in such a scenario, can’t just be assumed to dissolve after passing the X-date,” the Zillow report notes.

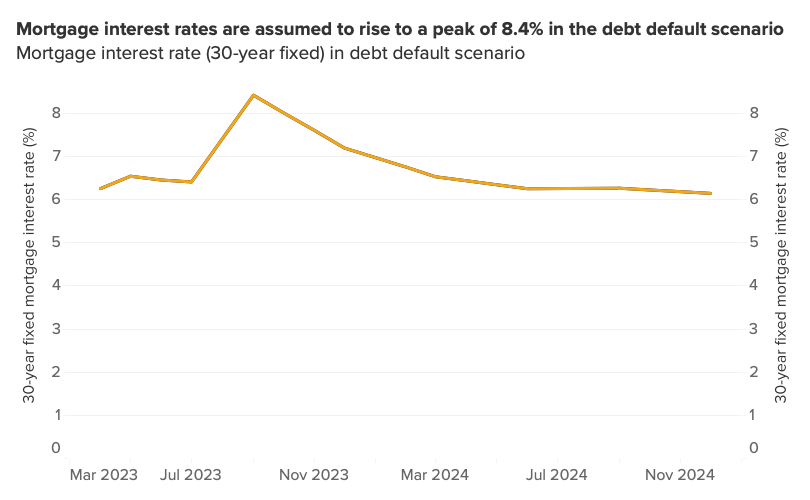

Additionally, Ii the U.S. were to enter default, one near-certain consequence would be rising debt yields and interest rates. Mortgage rates could reach 8.4 percent under a default scenario, according to Zillow estimates, making a mortgage payment on a typical home 22 percent more expensive and likely “freeze” the market.

In the event of a debt default, existing home sales volume could fall from a projected seasonally adjusted annualized rate of 4.3 million this April to 3.3 million in September.

Fitch Ratings issued a negative rating warning for the U.S., stating in part: “Increased political partisanship that is hindering reaching a resolution to raise or suspend the debt limit despite the fast-approaching x date (when the U.S. Treasury exhausts its cash position and capacity for extraordinary measures without incurring new debt). Fitch still expects a resolution to the debt limit before the x-date. However, we believe risks have risen that the debt limit will not be raised or suspended before the x-date and consequently that the government could begin to miss payments on some of its obligations. The brinkmanship over the debt ceiling, failure of the U.S. authorities to meaningfully tackle medium-term fiscal challenges that will lead to rising budget deficits and a growing debt burden signal downside risks to U.S. creditworthiness.”

![[Valid RSS]](https://californialistings.com/wp-content/uploads/2021/03/valid-rss-rogers.png)